Contents

Contents

The French and Indian War was a conflict fought by the Thirteen Colonies and the British Army against the French, with different Native American tribes supporting both sides, from 1754 to 1763.

The British and their colonies won the war, however, victory came at a cost.

Waging war in America was extremely expensive for the British taxpayer, due to the distances involved. The conflict was also a part of the larger Seven Years’ War, fought throughout Europe.

Therefore, at the end of the conflict, Britain was in a significant amount of debt – £133 million – which was a huge amount for the time.

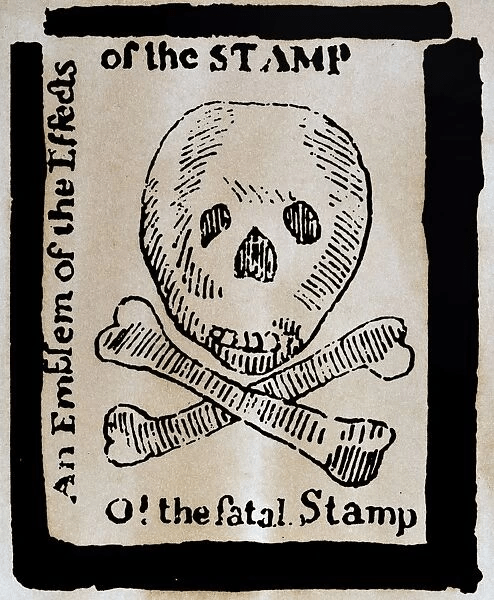

The Stamp Act

The primary purpose of the British Empire’s overseas colonies, in the eyes of the country’s leaders, was to raise revenue, and enrich Great Britain.

Therefore, in order to pay off the war debt, the British Parliament passed the Sugar Act in 1764, tightening export controls, and raising taxes on sugar and molasses in the Thirteen Colonies.

This was soon followed by the Stamp Act in 1765, introducing a wide-ranging tax on almost all printed goods, including newspapers, pamphlets, wills, and even educational diplomas.

The British justified the new taxes by saying that they would help to fund the continued protection of the Thirteen Colonies from future conflicts, and help the government to maintain the continued presence of the British Army in America.

The colonists were outraged, especially in response to the Stamp Act.

In the 150 years or so prior to 1764, the Thirteen Colonies had mostly been left to their own devices.

While the colonists were far from independent, the British had mostly failed to enforce colonial trade law during this period, under a policy known as salutary neglect. Customs enforcement was lax, meaning smuggling was common, and taxes were not always collected.

While the new taxes were not huge, they represented a significant shift in policy, and a loss of autonomy for the colonists.

They began to argue that the taxes were illegal under British law, because the English Bill of Rights forbade the government from imposing taxes without offering political representation. The Thirteen Colonies had no representatives in British parliament, leading them to adopt the slogan “no taxation without representation”.

Colonists also argued that the continued presence of the British Army in America was no longer necessary. They felt that they had already done their part to protect the Thirteen Colonies, and that it was unfair for them to be responsible for repaying the British war debt.

The Navigation Acts

Another law that the British began enforcing after the French and Indian War was the Navigation Acts.

The Navigation Acts were a long-standing series of British laws that restricted colonial trade, with the intent to enrich Great Britain.

The laws effectively prevented colonial trade with other countries not in the British Empire, ensuring that any trade that did occur was beneficial to Great Britain.

Under salutary neglect, and during the French and Indian War, these laws were very loosely enforced. This allowed colonial merchants to trade freely with other countries, such as the Netherlands, in order to make a living.

However, from 1764 onwards, the British adopted a more mercantilist policy, restricting trade with foreign powers, and enforcing the Navigation Acts, again in an attempt to help repay the war debt.

Colonists were once again outraged by this policy shift, and made continued attempts to flout the law, especially in key ports such as Boston. This, in turn, led to increased efforts by the British to combat smuggling, such as under the Townshend Acts in 1767, creating increased hostility between colonists and the British.

The Quartering Act

In 1765, the British implemented the Quartering Act.

The Quartering Act stated that the colonies were to provide housing and supplies to British Army units stationed in the Thirteen Colonies, to protect the colonies from future conflicts like the French and Indian War.

Once again, the colonists were significantly opposed to the idea that they had to financially support the British Army. They had already provided food, shelter, and supplies during the French and Indian War, and felt no need to continue stationing troops on the continent.

Some also felt that the presence of the British troops was an oppressive measure, designed to keep the colonists in line.

During the war, relations between British and American military leaders broke down significantly. The British were often condescending towards the colonial soldiers, and dismissive of their units’ ability in battle.

As a result, many colonies simply refused to abide by the Quartering Act. When British Army troops arrived in New York in 1766, the colonial government simply refused to provide housing, leaving the soldiers stranded on their ships, and enraging British political and military leaders.

Economic effect of the French and Indian War

The French and Indian War had been economically devastating in many parts of the Thirteen Colonies.

Many colonial governments had gone into significant debt to arm their militias, and defend their land against the French.

Internal taxes were raised, and inflation also increased. In addition, trade with the French was cut off during the war, hurting colonial merchants.

As a result, when the British began tightening trade restrictions and implementing new taxes, people living in the Thirteen Colonies found it hard to cope.

Due to colonial resistance, the Stamp Act was overturned in March 1766. But the British were unrelenting, introducing new taxes and restrictions as the years went on, allowing little breathing room for the Thirteen Colonies to recover from the economic impact of the French and Indian War.

Summary

The French and Indian War caused significant financial hardship for both Great Britain and the Thirteen Colonies.

In response to this, the British attempted to implement new taxes and regulations in the colonies, as they believed was their right as the British Empire.

However, the colonists, who were not used to regulations being enforced, found this extremely unfair, given the economic strain they were also under, and their lack of representation in British parliament.

Neither side was willing to cede ground on this issue, meaning that the conflict escalated, eventually leading to full-scale war.

The French and Indian War was a significant factor in the lead-up to the American Revolution. It was the catalyst for the implementation of new taxes and tighter trade restrictions, which were the root cause of conflict between the colonies and the British government.

However, other factors also played a role, especially the British government’s attitude towards their overseas territories, and their unwillingness to consider colonists’ grievances in response to the new laws.